Why are we talking about sharks, you might ask?

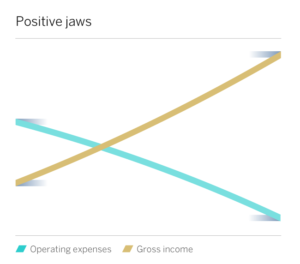

Jaws, in a financial sense, are a visual description of the state of your finances, derived from plotting revenue and expenses trends on X and Y axes. As such, they are an important tool to track your productivity.

- If your revenue exceeds your expenses you will have what is termed ‘positive’ jaws as shown in the picture below. Imagine a wide-open shark’s mouth!

- If your revenue is closer to, or less than your expenses, the gap closes and these lines result in what we call ‘negative jaws’. Negative jaws can really bite. Duunnn duunnnn….

From a trend perspective, it is very useful to look at revenue growth versus expense growth on a quarter on quarter basis. If your ‘jaws’ are getting wider, this is good news, but if they are starting to narrow or close, this signals an imminent loss sometime in the future, meaning it’s time to take stock and reverse the trend

Image source (L) bbva.com (R) teepublic.com

Encouraging Positive Jaws.

In a nutshell, the wider the jaws, the happier you should be. Positive jaws signal strong productivity. So, how do we encourage this?

There are two key areas to focus on to achieve positive jaws.

- Firstly, work to grow your revenue faster than your expenses.

- Secondly, ‘sweat’ your assets as hard as you can to maximise your return. By this, I mean accomplishing more with the same amount of resources or achieving higher output from the same investment.

How to break an asset sweat and look good in the process

Sweat your fixed assets

- A good example of improving the productivity of a fixed asset is the rent McDonald’s pays. Let’s say a McDonald’s franchisee pays $100,000 in rent per annum and is open from 7am to 7pm. If she can open 24/7, as many now do, the fixed cost of rent is now ‘sweating’ 24/7. Of course, customer demand, revenue generated and the resultant increase in variable costs has to make sense too.

- Another example is selling your wares from a physical site, versus a digital space, such as a website. A website, in theory, allows an entire globe of digital customers to access your business 24/7, compared to your physical site, which is constrained by your operating hours and how far your potential customers are willing to travel.

Outsource to sweat your variable assets

Accounting, marketing, legal, shipping services, and even HR are all good examples of variable expenses you may be able to better ‘sweat’ by outsourcing. When you outsource, you get to hand the work to someone who specialises in the role and, generally, this means they’re faster and more expert at using this skill to grow your business. Outsourcing also offers greater flexibility and lower risk than managing the people and materials required to get these important jobs done yourself.

The golden rule to outsourcing is this: You generally get what you pay for. Don’t be tempted to go for the cheapest rate. A specialist is always going to be better than a generalist and paying a bit more upfront in these situations will usually generate a much better ROI.

Question every dollar you spend

Channel your inner Scrooge McDuck (just for a brief moment). Every time you go to reach into your pocket ask yourself: Will what I am about to spend money on generating profitable revenue? Or can I spend that dollar elsewhere to generate a better ROI?

Adopt a continuous improvement mindset

Positive jaws need constant nurturing and improving productivity is a lifelong effort. Never rest on your laurels and always be on the lookout for fresh ways to work smarter and improve that bottom line. You might like to consider crafting a productivity plan to keep your ambitions in check and you’ll definitely want to make sure you measure and track the success (or failure!) of your productivity initiatives.

Worried your financial jaws are closing and not sure what to do next? Send us an email and we’d be happy to help! info@grownzbusiness.co.nz