What a year!

When I was making my New Year’s resolutions on 31 December 2019, I failed to account for how a global health pandemic may impact my plans. Whoops.

It’s been a rollercoaster of a year for sure, but overall, I’d have to say there were as many highs as there were lows and surprises. The team at Grow NZ saw our opportunity to help Kiwi businesses in need when lockdown hit and I’m proud of how we managed to work 7 days a week for the entire lockdown period, running daily webinars that many of you attended, executing business continuance plans and designing new marketing strategies for many of you to gear you up to survive and thrive. We facilitated many, many phone calls, so many zoom calls and thousands of email conversations. And we did it all for our love of kiwi business.

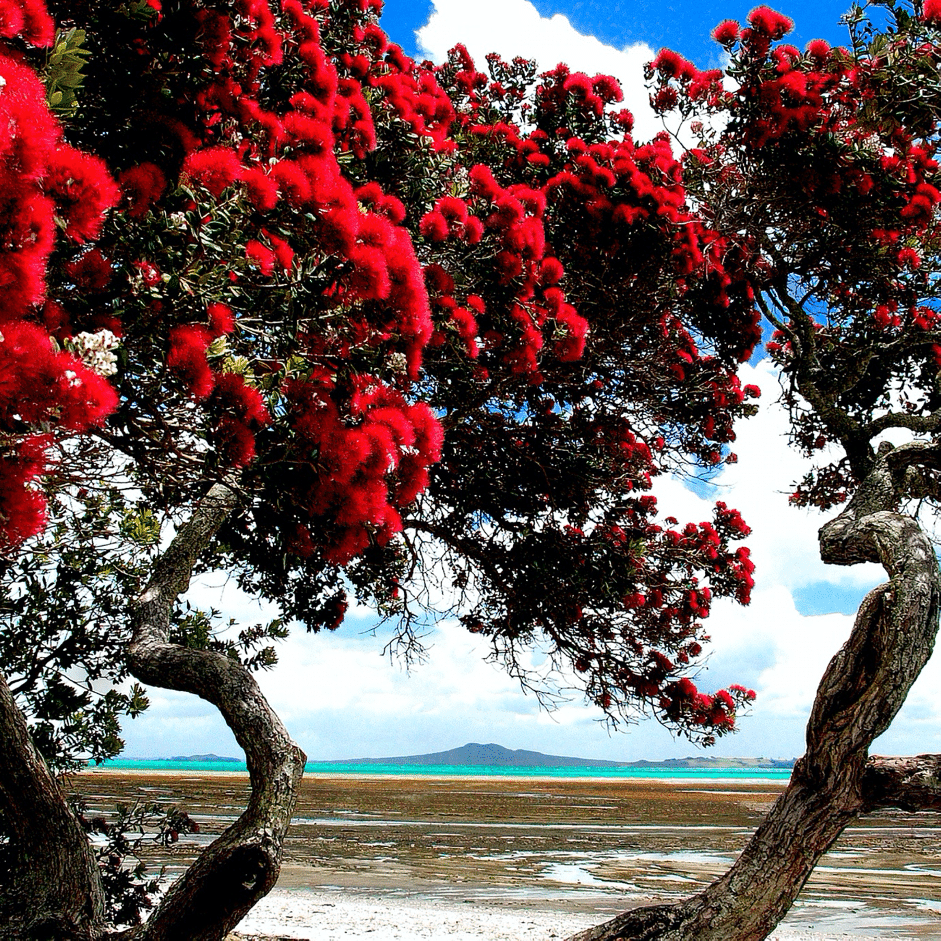

I have to admit however, I have found myself feeling a little tired over the past couple of weeks, not physically, but mentally and also emotionally. I’m definitely ready to put my feet up for a couple of weeks and relax with family and friends in this beautiful country we are so fortunate to call home.

I know a lot of you are feeling the same way, so, for our very final newsletter of the year, I want to take the opportunity to say a big well done to you all and recap some of the main learnings we can all carry through to 2021 with us.

We are determined to do all we can to help you achieve your business dreams, so, based on your feedback, we are increasing our proposition next year to include monthly webinars and monthly eBooks for you to access. These will be available in the new members portal early in the new year.

I would also like to extend a very warm welcome to the many Heartland Bank business clients who joined us as members last week, it is great to have you on board and we look forward to working with you in 2021 and beyond.

Merry Christmas team – here’s to a confident start to 2021 for us all.

While 2020 was a year many of us would rather forget, it did come with some important lessons that will stand us in good stead for the years ahead. Here are my top 4.

1. Plan for the unexpected

As much of the world comes out of pandemic response mode and into recovery mode, we all need to get used to planning for various scenarios. On a global scale, we can expect recovery efforts to wax and wane – and that’ll impact our economy and access to goods too. Having said that, it certainly appears the Kiwi brand has done phenomenally well internationally, and I believe this positions us for an influx of tourists as well as talent, as individuals and organisations look to New Zealand as a safe haven.

I personally find myself feeling quite optimistic about 2021, and even more so about 2022. With the release of a viable vaccine, the OECD is suggesting real gross domestic product (GDP) growth is projected to reach pre-pandemic levels by the end of 2021. Having said that, I’ve learnt my lesson and I’m busy preparing plans B, C and D, just in case the world’s not done with its curveballs.

2. Cash is still king

Crisis or no crisis, this is a universal truth and now, more than ever, we should all be taking the time to revisit our cashflow status to ensure we enter COVID-19 recovery as robust as possible. The better your cashflow, the more flexible and resilient you are able to be. Ideally we’d all have three months of available cashflow at our disposal. Here are some things we can all do right now to improve our cashflow, as well as actions we can take further down the path of economic recovery. I call these ‘survive and thrive’ measures.

Survive

- Create a realistic reset of your cashflow expectations. What’s coming in? What can you be invoicing for? Can you change payment terms?

- Make sure your accountant and banker are your ‘best friends’. If you haven’t already, pick up the phone and connect.

- Balance collections, survival and relationships – remember to play the long game with important customers.

- Watch that ROI. Every dollar spent must generate cash & profit.

- Double down on profitable sales and marketing. If you can, now is the time to invest in profitable initiatives.

Thrive

- Invest in digital/ eCommerce, if COVID-19 has taught us anything, it’s that no-one can afford not to anymore.

- Data is a valuable asset – re-sell, cross-sell and leverage it every way you can.

- Leverage reduced competition – now’s your time to shine!

- Build networks and reduce single point sensitivities.

- Increase efficiencies by considering alternative business models.

3. Always, always walk in your customers’ shoes

It’s not just us business owners navigating our way through our ‘new normal’, our customers are too and, alongside all the stress this pandemic and its associated restrictions have brought, we also have a fresh opportunity to engage, or re-engage, target customers by leveraging unprecedented levels of common ground and fulfilling fast-changing consumer demands.

So, why not take some time to walk in your customers’ shoes – but before you do, take yours off first! Do this by:

- Finding out what it’s like to call your business for support.

- Walking into your store and browsing your shelves/purchasing a product and thinking about how the experience makes you feel.

- Browsing your website for information about your services.

- Asking yourself, ‘do I sell what I do, or do I sell what my customer’s want?’ Theses are often two different things; the ability to communicate with your customers in their language, based on what they want is often the difference between success and failure.

Experience your company from the outside, and then get busy on the inside. Who knows where your customers’ shoes could take you!

4. Remember we are here to help

With marketing support…

You heard us talk a lot this year about the importance of marketing in a crisis. “When times are good you should advertise. When times are bad you must advertise.” Like all cliches, this phrase is over-used for a good reason. It is well-documented that brands that increase advertising during a recession can improve market share and return on investment much more efficiently when things pick up again.

As a registered service provider with the Regional Business Partner Network, Grow NZ Business continues to offer companies assistance with business continuance and marketing strategy, and your business may be eligible for 50% subsidised support. Read more about how to access these subsidies. We would love to help you.

And growth accountancy…

If 2020 taught us anything it’s that we shouldn’t be throwing cash around willy-nilly without a solid return on investment. With this in mind, does your accountant provide more of a service than a subscription to MYOB or Xero would?

Today’s business owners need growth partners. A professional who not only has your tax and compliance covered, but who also helps you seek out growth. A trusted advisor who can point you in the right direction of the best marketers, HR experts and the latest technology deals. An accountant who wants to do more than check IRD boxes. A Grow NZ Accountant.

Find out how a Grow NZ Accountant can help you grow in 2021 and beyond.

We admire you enormously and deeply appreciate the value you add to New Zealand. Your courage, passion, commitment and expertise creates value, jobs and pride across the country. We know it is not always easy, but it’s always worth it.

Well done to you for getting through 2020 and Merry Christmas!