The moment we all burst our lockdown bubbles, we entered another one. We entered a bubble where customers release their pent-up spending and revel in the opportunity to shop and renovate. Where people, craving a sense of normality, book domestic weekend getaways and re-commit to monthly trips to the hairdresser. But, just like our lockdown bubble did, this bubble too will pop and before it does you must make sure you’ve done all you can to keep your business running profitably for the harder months ahead.

Our new bubble.

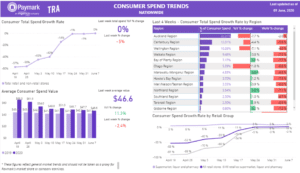

For a great deal of us, this new bubble, let’s call it the spending bubble, feels great. The expected bounce back with the change in Alert Levels is playing out as expected and it’s proving particularly refreshing for our regions, who on a year-on-year basis, are performing better than our bigger centres in Auckland, Christchurch and Wellington, which continue to suffer the effects of reduced spending. You can see more detail on national spending averages in the charts below, put together by NZ payments provider, Paymark.

As you would expect, some industries are having a better time than others too. Areas we have seen strong performance in are home improvements, local tourism, motor vehicle services and beauty and home maintenance services, while industries like hospitality continue to be significantly impacted, with average spending over April and May well down on the same time a year ago. If you’re interested, you can keep track of national spending statistics yourself via Statistics NZ.

We expect, but hope to be wrong, that our spending bubble will pop over the next couple of weeks and that July to December will be the most difficult period in a decade as an increase in redundancies, the reduction of wage subsidies and the sustained lack of international tourist dollars start to bite. Market confidence will drop – but yours doesn’t have to.

Don’t burst when the spending bubble does.

When it comes to business resilience, Grow NZ Business has noticed that those businesses with a deep understanding of customer demand are doing best. It might sound obvious, but there is a strong correlation of out-performance from those who understand market trends and use these insights to fuel profitable marketing campaigns. I’ve said it before and I’ll say it again, do not cut back on profitable marketing now. If anything, ramp it up.

Many businesses who haven’t heeded this advice are finding themselves at the mercy of the cashflow spiral. Yes, this will be driven in part by market conditions, but it’s mainly due to some business owners mistakenly cutting back on profitable marketing investment when lockdown hit. So, our advice – understand your market data and employ profitable, cashflow-driven marketing strategies to capture and influence demand.

To reinforce this message, I’d like to share a case study from one of Grow Digi’s clients, NZ Ski, which has just had a record opening for its Mt Hutt Ski season. The insights show there is a strong desire to support local, ‘cabin fever’ is driving people to get out and about and there is approximately $ 1.5 billion, usually reserved for overseas travel at this time of year, that needs a local outlet! All-in-all in this led to a happy client and some great PR too – check it out.

There’s still time to invest – get in before the spending bubble pops.